Yearly depreciation formula

You can use the following basic declining balance formula to calculate accumulated depreciation for years. The accelerated method makes the asset lose value at a faster rate than the straight-line method.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

If you are interested in the derivation see Reference 2 at the bottom of this page.

. Read more after 4 years. The formula for calculating depreciation using each of these methods is given below. To calculate this value on a monthly basis divide the result by 12.

This Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets. If you use this method you must enter a fixed yearly percentage. N Period which takes values from 0 to the nth period till the cash flows ending period C n Coupon payment in the nth period.

This return provides details about the compounded. The straight-line depreciation formula is. To calculate use this formula.

Depreciation Amount Declining-Bal. Divide the cost of the asset minus its salvage value by the estimated number of years of its useful life. The salvage value is the estimated amount of money the item.

After 6 years and also find out the total amount Simple Interest paid by the Company at the end of tenure. D j C-S nn-j1T where T0. The following formula calculates depreciation amounts.

Here we have discussed how to calculate the Mean along with practical examples. The following formula determines the rate of depreciation under this method. This is known as the straight-line method for calculating depreciation cost and its the only acceptable formula for calculating the depreciation cost of a property according to the IRS.

Double-Declining Balance DDB Depreciation Method Definition With Formula The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a. For simplicity assume that the only operating expense of the company is depreciation expense no rent expense wage expense etc. Simple Interest Formula Example 2 ABC Ltd has taken a Long-term borrowing of INR 1000000 with an interest rate of 55 per annum from DCB Bank.

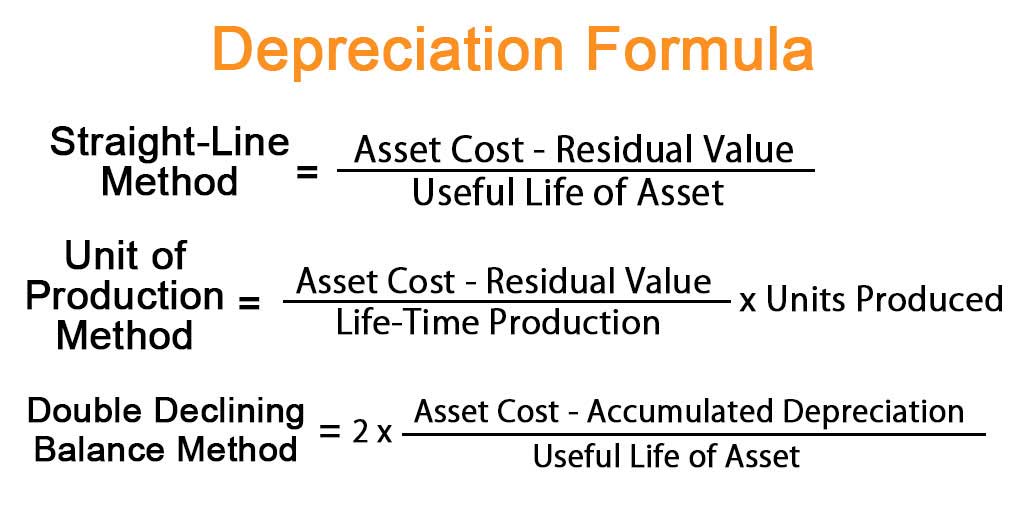

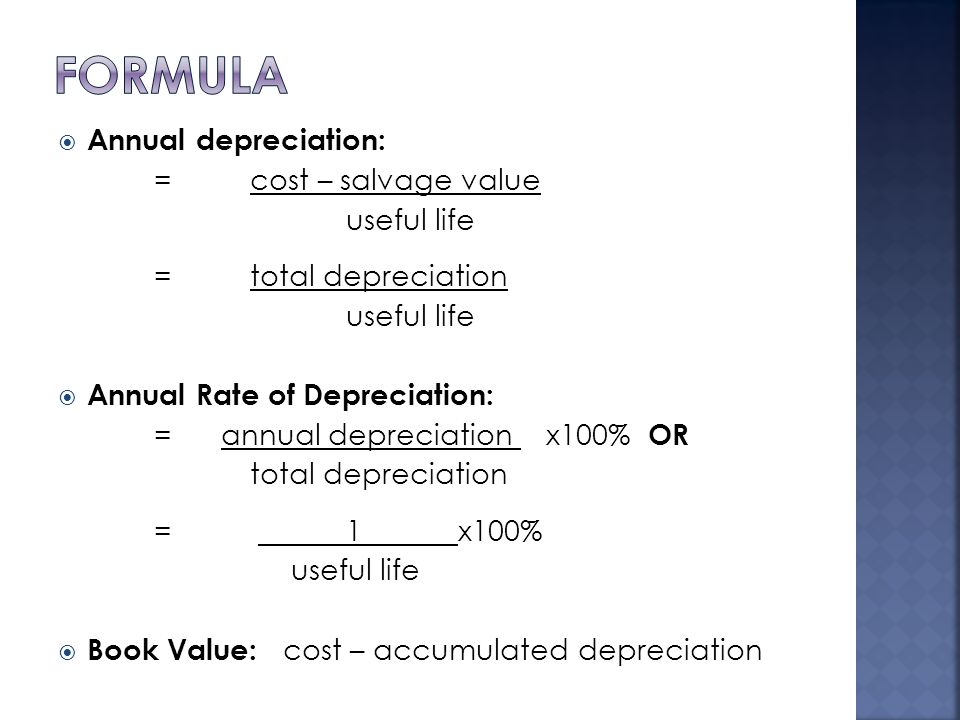

Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset. It is a contra-account the difference between the assets purchase price and its carrying value on. Calculate the simple interest paid by ABC Ltd.

Owns machinery with a gross value of 10 million. If you use this method you must enter a fixed yearly percentage. This formula can be derived from the compound interest formula based on the fact that the total future value is the sum of each individual payment compounded over the time remaining.

It also refers to the spreading out. This is a guide to Mean Formula. Asset cost - salvage value useful life annual depreciation.

Guide to Solvency Ratio Formula. Basis 100. We also provide a Mean calculator with a downloadable excel template.

Depreciation cost - salvage value years of useful life. The formula for calculating the annual percentage rate inflation in the CPI over the course of the year is. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

The SOYD depreciation formula is. Now Calculate the depreciation Calculate The Depreciation The Depreciation Expense Formula computes how much of the assets value can be deducted as an expense on the income statement. Purchase cost- salvage valueuseful life.

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. Consumers rose by approximately four percent in 2007. X Number of Depreciation Days x Depr.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Accumulated depreciation recorded Accumulated Depreciation Recorded The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. Examples of Portfolio Variance Formula.

The calculation of yearly depreciation under WDVM for 2019 and 2020 is as follows. Calculate yearly depreciation to be booked by Mark Inc on 31122019 and 31122020. The balance is the total depreciation you can take over the useful life of the equipment.

With Free Online Depreciation Calculation Tool you can calculate the total depreciation on a given asset using the Written Down ValueWDV method. The formula for straight-line depreciation is. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

For instance the Year 1 factor is 1055 the Year-2 factor is 955 etc. 1 nth root of Residual ValueCost of the asset 100 where n useful life. Divide the balance by the number of years in the useful life.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. This lets us find the most appropriate writer for any type of assignment. Annual factor x Depreciable amount.

Depreciation Amount Declining-Bal. The following formula calculates depreciation amounts. Double declining balance method.

YTM interest rate or required yield P Par Value of the bond Examples of Bond Pricing Formula With Excel Template Lets take an example to understand the calculation of Bond Pricing in a better manner. If you want to assume a higher rate of depreciation you can multiply by two. Read more on furniture.

To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. It creates a more significant depreciation which allows for greater tax deductions and minimizing the taxable income during the assets first years. X Number of Depreciation Days x Depr.

- For each asset choose between the Straight-Line Sum-of-Years Digits Double Declining Balance or Declining Balance with Switch to Straight-Line. For example consider a company that generates yearly revenues of 100000. You may also look at the following articles to learn more Calculation of Price Elasticity.

Firstly determine the earnings from an investment say stock options etc for a significant time say five years. Form the yearly factors by dividing the digits sum into the years remaining. Get 247 customer support help when you place a homework help service order with us.

Basis 100. Yearly Depreciation Closing. The resulting inflation rate for the CPI in this one-year period is 428 meaning the general level of prices for typical US.

Now calculate the average annual return Annual Return The annual return is the income generated on an investment during a year as a percentage of the capital invested and is calculated using the geometric average. Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset. Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value.

For the above transaction the. In Excel and Google Sheets we can use the FV function again. The formula for calculating straight-line depreciation is.

This gives you the yearly depreciation deduction.

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

A Complete Guide To Residual Value

Double Declining Balance Method Of Depreciation Accounting Corner

Gt10103 Business Mathematics Ppt Download

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula And Calculation Excel Template

Double Declining Balance Method Of Depreciation Accounting Corner

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Straight Line Depreciation Formula Guide To Calculate Depreciation

Accumulated Depreciation Definition Formula Calculation

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Macrs Depreciation Calculator With Formula Nerd Counter

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube